OZ Pitch Day Recordings

A Brief History Of Opportunity Zones

Updated January 22, 2024

A brief history of Opportunity Zones (and why they exist in the first place) can provide helpful context for participants in the program.

Opportunity Zones are a place-based economic development program that was first conceptualized by the Economic Innovation Group (EIG) in a 2015 white paper, Unlocking Private Capital to Facilitate Economic Growth in Distressed Areas.

Free PDF Download

Get the full PDF version of this guide, Opportunity Zones Explained. Download it here.

The white paper was co-authored in bipartisan fashion by Jared Bernstein and Kevin Hasset. Bernstein is a Democrat who had previously served as an economic adviser to then-Vice President Joe Biden and would later return to the White House to serve as chair of President Biden’s Council of Economic Advisers. Kevin Hasset is a Republican who would later become a senior economic adviser to President Donald Trump.

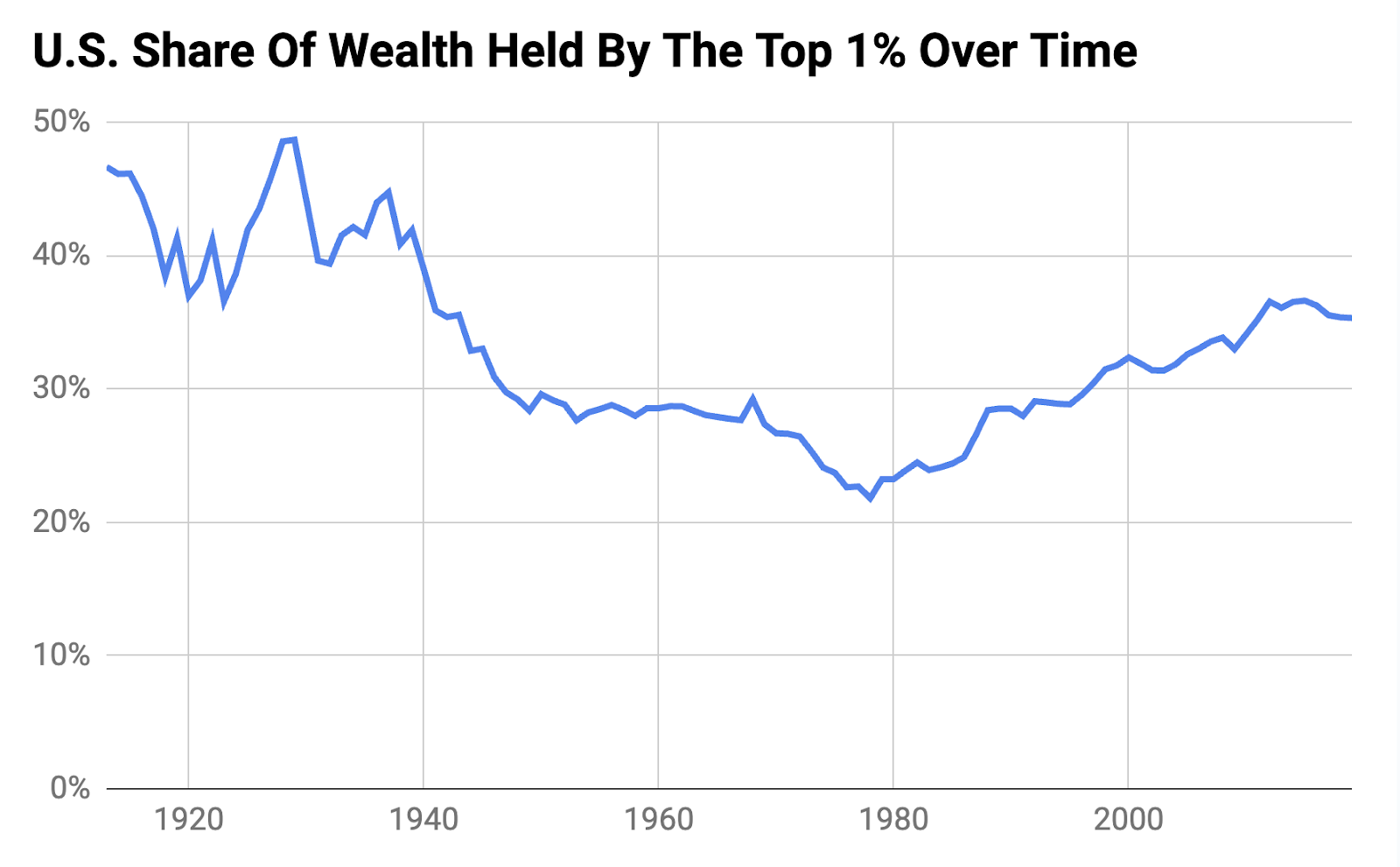

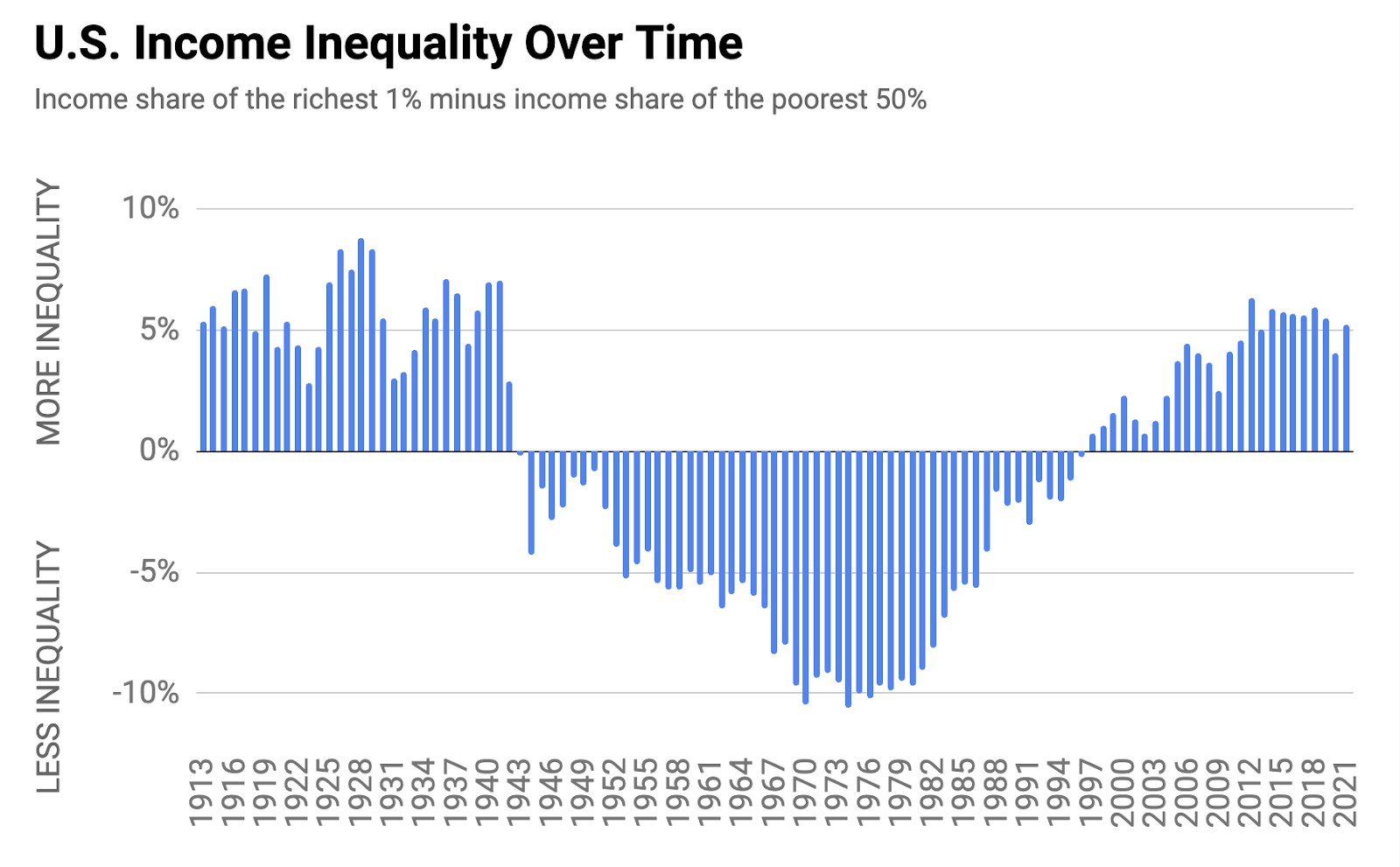

Policymakers studying the recovery following the Great Recession of 2007-09 noticed that wealthy communities recovered very quickly, but low-income communities got left behind. Wealth inequality and income inequality had increased significantly.

By just about any measure, wealth and income inequality in the U.S. today are near their highest levels since World War II.

And thus, policymakers on both sides of the aisle were in search of a solution to help address these societal concerns. The policy challenge was, “How can we incentivize wealthy individuals to invest some of their wealth into these low-income areas to stimulate these local economies at scale?”

The solution was Opportunity Zones, a bipartisan, place-based policy initiative that incentivizes investors to redeploy gains from successful investments into new, long-term investments in struggling communities that normally don’t receive private investment dollars.

The policy goal of Opportunity Zones is to stimulate economic revitalization in low-income communities. And the investor incentives to help achieve this outcome are capital gains tax deferral and unlimited tax-free growth.

Opportunity Zone legislation was first introduced in 2016 and subsequently reintroduced in 2017 as the Investing in Opportunity Act. The bill was championed by Senators Tim Scott (R-SC) and Cory Booker (D-NJ) and Representatives Pat Tiberi (R-OH) and Ron Kind (D-WI).

Most of the provisions contained within the Investing in Opportunity Act were eventually enacted as part of the 2017 Tax Cuts & Jobs Act, which was signed into law by President Donald Trump on December 22, 2017.

Equity Investment in Opportunity Zones

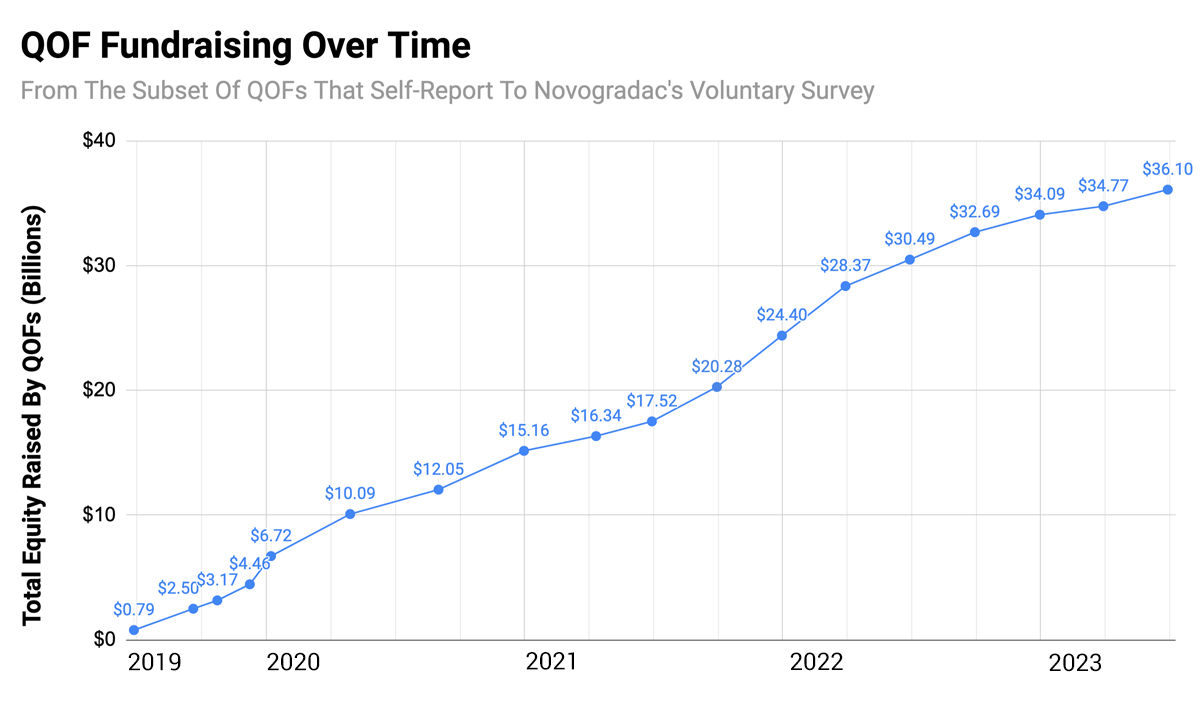

EIG founder Steve Glickman claimed in 2018 that Opportunity Zones would be “the biggest economic development program in U.S. history.” Then-Treasury Secretary Steven Mnuchin predicted that over $100 billion in private capital would be invested in Opportunity Zones.

Opportunity Zones have shattered the expectations of even the most optimistic supporters of the program. In October 2022, OpportunityDb extrapolated Novogradac survey data to estimate that Opportunity Zone investments had likely already exceeded $100 billion.

Opportunity Zones Timeline

| April 15, 2015 | Opportunity Zones first conceptualized in EIG white paper. |

| April 27, 2016 | Investing in Opportunity Act introduced in 114th Congress. |

| February 2, 2017 | Investing in Opportunity Act reintroduced in 115th Congress. |

| December 22, 2017 | Opportunity Zones legislation enacted as part of the Tax Cuts & Jobs Act. |

| Early 2018 | U.S. states, territories, and the District of Columbia nominated census tracts as Qualified Opportunity Zones. |

| July 9, 2018 | 8,762 Qualified Opportunity Zones certified by IRS in Bulletin 2018-28. The first QOFs launched later this month. |

| August 1, 2018 | OpportunityDb launched. |

| December 14, 2018 | Treasury certified two additional Opportunity Zones in Puerto Rico, bringing the total (and current) number of OZs to 8,764. |

| December 19, 2019 | IRS issued final regulations on Opportunity Zones. |

| December 31, 2019 | 15% basis step-up benefit expired after this date. |

| December 31, 2021 | 10% basis step-up benefit fully expired after this date. (But the biggest benefits are still available.) |

| April 7, 2022 | Opportunity Zones Transparency, Extension, and Improvement Act introduced in 117th Congress. The bill failed to advance. |

| September 2023 | Opportunity Zones Transparency, Extension, and Improvement Act reintroduced in 118th Congress. This bill has not yet passed. |

| December 31, 2026 | Gain deferral date. Unless extended by Congress, gains triggered after this date will not be eligible for OZ investment. |

| April 2027 | Deferred eligible gains tax liability due for OZ investors. |

| June 28, 2027 | Last possible date on which an investor can invest a 2026 gain into a Qualified Opportunity Fund, assuming gain on 12/31/2026. |

| September 11, 2027 | Last date on which an investor can invest a 2026 gain reported on a K-1 into a Qualified Opportunity Fund. |

Table Of Contents: Opportunity Zones Explained

This page is part of our larger beginner’s guide to OZs: Opportunity Zones Explained. Follow the links below to read through the entire guide. Or, click here to download the full PDF version.

- Chapter 1: Opportunity Zones Explained — The basics of the OZ program.

- Chapter 2: Opportunity Zone Tax Benefits — How the OZ tax break works.

- Chapter 3: A Brief History Of Opportunity Zones — Policy background on the OZ legislation.

- Chapter 4: Where Opportunity Zones Are Located — Includes the map of Opportunity Zones.

- Chapter 5: Two Ways To Invest In OZs — Active vs. passive options for investing.

- Chapter 6: How To Invest In Opportunity Zone Funds — QOF investments for passive LP investors.

- Chapter 7: How To Start Your Own OZ Fund — How to create a self-managed OZ fund.

- Chapter 8: Opportunity Zones vs. 1031 Exchanges — Two popular tax deferral programs.

- Appendix: The Best Opportunity Zone Resources To Learn More — Recommended links.

About The Author

Jimmy Atkinson is a renowned Opportunity Zones industry leader. He founded OpportunityDb in 2018 as the leading OZ educational platform and investment marketplace. He is also founder of OZ Insiders, the premier private community for Opportunity Zone professionals and investors. And he hosts The Opportunity Zones Podcast.