OZ Pitch Day - June 13, 2024

Opportunity Zones Explained: The Beginner’s Guide To OZs

Updated January 22, 2024

The Opportunity Zone policy isn’t just the biggest economic development program in U.S. history.

It’s also the greatest tax incentive ever created.

Using Opportunity Zones, investors now have the opportunity to unlock unlimited tax-free growth.

This guide provides comprehensive information on Opportunity Zones, how to invest, and the powerful tax benefits available to investors.

Free PDF Download

Get the full PDF version of this guide, Opportunity Zones Explained. Download it here.

Table Of Contents

This guide, Opportunity Zones Explained: The Beginner’s Guide To Opportunity Zones, is arranged into the following sections.

Chapter 1: Opportunity Zones Explained

Opportunity Zones are a powerful yet time-limited tax incentive, driving the most significant economic development initiative in U.S. history. The incentive gives investors a new way to generate unlimited tax-free growth, making it the greatest tax-advantaged investment program ever created.

Chapter 2: Opportunity Zone Tax Benefits

To encourage investment in economically distressed Opportunity Zones, there are multiple tax benefits available to U.S. taxpayers who reinvest eligible gains into Opportunity Zones via a Qualified Opportunity Fund. The ability to achieve unlimited tax-free growth makes Opportunity Zones the greatest tax break ever created.

Chapter 3: A Brief History Of Opportunity Zones

A brief history of Opportunity Zones (and why they exist in the first place) can provide helpful context for participants in the program. Opportunity Zones are a place-based economic development program that was first conceptualized by the Economic Innovation Group (EIG) in a 2015 white paper, Unlocking Private Capital to Facilitate Economic Growth in Distressed Areas.

Chapter 4: Where Opportunity Zones Are Located (The OZ Map)

Opportunity Zones are located in urban, suburban, and rural areas. They are in every major city in the United States. They are in every state and overseas territory. And they are in our nation’s capital. Opportunity Zones account for roughly 12 percent of the landmass of the country. Chances are you live in or not far from an Opportunity Zone.

Chapter 5: Two Ways To Invest In OZs

In general, there are two ways to invest in Opportunity Zones: 1) In an active QOF investment, an investor who has realized a gain and wishes to take a hands-on approach to managing his next investment as a general partner, or GP, may create his own Qualified Opportunity Fund and invest his gain into this QOF to fund a property, business, or portfolio of assets. In a passive QOF investment, an investor may take a more “hands off” approach.

Chapter 6: How To Invest In Opportunity Zone Funds

In general, Qualified Opportunity Funds are private placement funds that do not trade publicly on an exchange. That is to say, shares (or interests) in Qualified Opportunity Funds are not available at a brokerage in the traditional way stocks, bonds, mutual funds, or ETFs are bought and sold. Rather, Qualified Opportunity Funds are more similar to private equity funds or private equity real estate funds.

Chapter 7: How To Start Your Own OZ Fund

Qualified Opportunity Funds (QOFs) were created under the Investing in Opportunity Act, a version of which was passed as part of President Trump’s Tax Cuts & Jobs Act of 2017. These new Opportunity Zone funds provide massive tax incentives for re-investing capital gains in some of America’s most economically distressed communities. Starting a Qualified Opportunity Fund is easy.

Chapter 8: Opportunity Zones vs. 1031 Exchanges

Sophisticated real estate investors are familiar with Section 1031 exchanges, and related Delaware statutory trusts (DSTs). Opportunity Zones appear similar at first glance. But there are some substantial differences.

Appendix: The Best Opportunity Zone Resources To Learn More

Opportunity Zones were nominated at the state level in the first half of 2018 before being certified by the U.S. Department of Treasury. This is a list of Opportunity Zone resources from OpportunityDb, plus additional resources from federal, state, local governments, and national advocacy and economic research organizations.

More Ways To Learn About Opportunity Zones

PDF Download: Full Guide

Looking for the comprehensive version of this guide in a single PDF document? Download the full version of Opportunity Zones Explained: The Beginner’s Guide To OZs in PDF format.

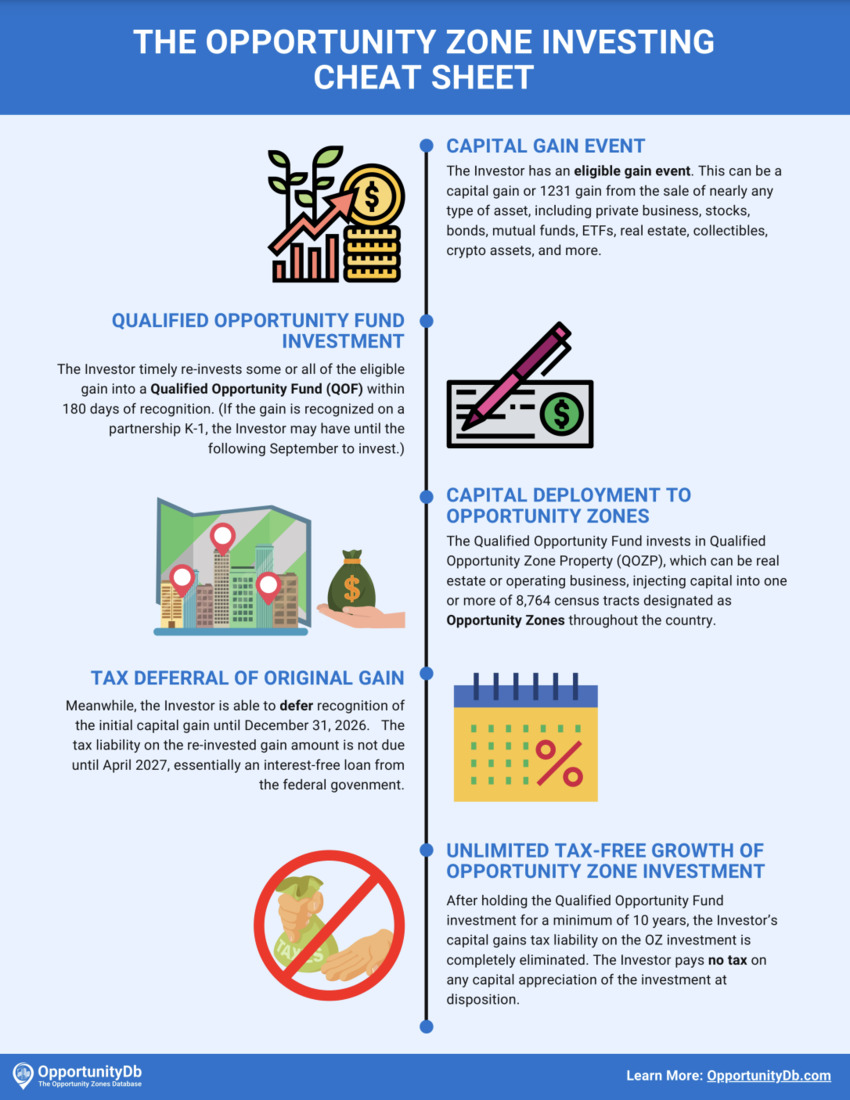

PDF Download: Cheat Sheet

Looking for a quicker guide? Download The Opportunity Zone Investing Cheat Sheet, our one-page visual explainer of how investing in Opportunity Zones works.

Watch Our Opportunity Zones Video Crash Course

Want a video version of this guide? Watch our 25-minute crash course that’s now available on YouTube.

About The Author

Jimmy Atkinson is a renowned Opportunity Zones industry leader. He founded OpportunityDb in 2018 as the leading OZ educational platform and investment marketplace. He is also founder of OZ Insiders, the premier private community for Opportunity Zone professionals and investors. And he hosts The Opportunity Zones Podcast.