OZ Pitch Day Recordings

Senate Finance Chair Queries Opportunity Zone Funds

Senator Ron Wyden (D-OR) has sent letters of inquiry to seven Qualified Opportunity Funds seeking information about projects in which the QOFs have invested and details on temporary and permanent jobs created.

Recipients of letters from Sen. Wyden included SkyBridge Capital, Baker Tilly, Cresset Partners, Hatters Sky, PTM Partners, Related Group, and Shopoff Realty Investments.

In his letters, Sen. Wyden, who chairs the Senate Finance Committee, contends that Opportunity Zones may not live up to their promise. He wrote, “I have long been concerned that the Opportunity Zone program may permit wealthy investors another opportunity to avoid billions of dollars in taxes without meaningfully benefitting the distressed communities the program was intended to help.”

Sen. Wyden also referenced a recent report from the Government Accountability Office (GAO) which noted that several OZ fund managers indicated that they would have proceeded with projects even if the tax incentives did not exist.

It appears that Sen. Wyden and his staff have carefully selected a handful of Opportunity Zone projects that invest in projects that he would consider to be abusive under his proposed Opportunity Zone reform legislation.

One such group to receive a letter is Shopoff Realty Investments, which is developing a luxury hotel and casino in an Opportunity Zone on the Las Vegas Strip.

Bill Shopoff, president and CEO, touted the economic impact that his group’s project will have on the local community.

“Our project will create over 4,200 jobs during the construction period (that includes over 1,200 jobs on site and 3,000 trades working off site during the life of the construction), and over 800 permanent jobs in Las Vegas, which has been particularly hard hit from the Covid-19 pandemic. This is exactly what this legislation was intended to accomplish,” Mr. Shopoff said.

Sen. Wyden has long been a proponent of raising taxes on the rich. That position has put him at odds with his son, a wealthy hedge fund manager who has publicly voiced his opposition at times:

History Of The OZ Program

Opportunity Zones were created with broad bipartisan support. The policy is based on the bipartisan Investing in Opportunity Act, which was promoted by Senators Tim Scott (R-SC) and Cory Booker (D-NJ) and Representatives Pat Tiberi (R-OH) and Ron Kind (D-WI). That bill was cosponsored by nearly 100 lawmakers in the House and Senate.

Opportunity Zones were ultimately created as part of the Tax Cuts and Jobs Act of 2017. That piece of legislation passed through the Senate by a 51-48 margin. Only 51 votes were needed since the legislation was passed via the budget reconciliation process; as part of that process, reporting requirements that were included in initial versions of the bill were removed.

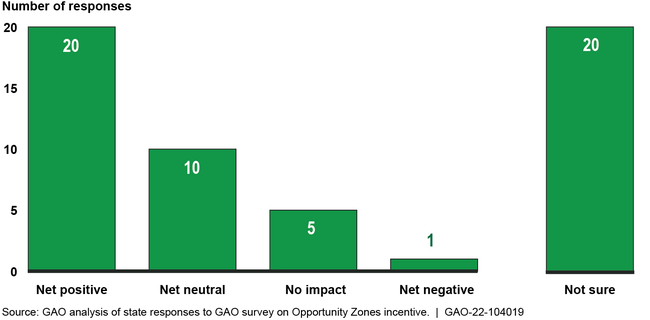

A 2021 GAO survey of government officials from all 50 states, Washington, D.C., and the five U.S. territories revealed overwhelmingly positive sentiment towards the Opportunity Zone program.

There have been several proposed amendments to strengthen the reporting requirements, including a bipartisan proposal put forth by Senators Tim Scott (R-SC), Todd Young (R-IN), Cory Booker (D-NJ), and Maggie Hassan (D-NH).

Shay Hawkins, a former aide to Sen. Scott, discussed this process more at OZ Pitch Day Fall 2021:

Additionally, Brookings Institution senior fellow David Wessel appeared on the Opportunity Zones Podcast in 2021 to discuss his investigation into Opportunity Zones: