OZ Pitch Day Recordings

Developing in Chicago’s Opportunity Zones, with Lennox Jackson

Chicago is home to 133 opportunity zones. But which neighborhoods on Chicago’s West and South Sides have the greatest levels of redevelopment need? And what are some of the challenges of acquiring capital for building in low-income communities?

Lennox Jackson is founder and CEO of Urban Equities, a Chicago-based real estate developer and advisor that specializes in residential, retail, and commercial projects.

Note: this is Part 2 of my conversation with Lennox. If you missed it, click here for Part 1, where we discuss why gentrification may be a good thing.

Episode Highlights

- Developing mixed-use retail/residential in Bronzeville.

- Re-purposing a closed public school in Washington Park into workforce rental housing and indoor agriculture.

- Hemp and product manufacturing as a job creator.

- Workforce development and housing campus for prisoner re-entry.

- The challenges of acquiring capital for building on Chicago’s South Side.

- How local governments are still trying to find their way in terms of being a good resource not only for local developers but also investors across the country.

- How Chicago city government leadership is changing as the Opportunity Zones program begins gain traction.

- The neighborhoods on Chicago’s West and South Sides with the greatest levels of redevelopment need.

- The case for community development in Bronzeville and the importance of leveraging institutional anchors and infrastructure like McCormick Place, WinTrust Arena, Lake Michigan, and a large amount of vacant land in South Side Chicago.

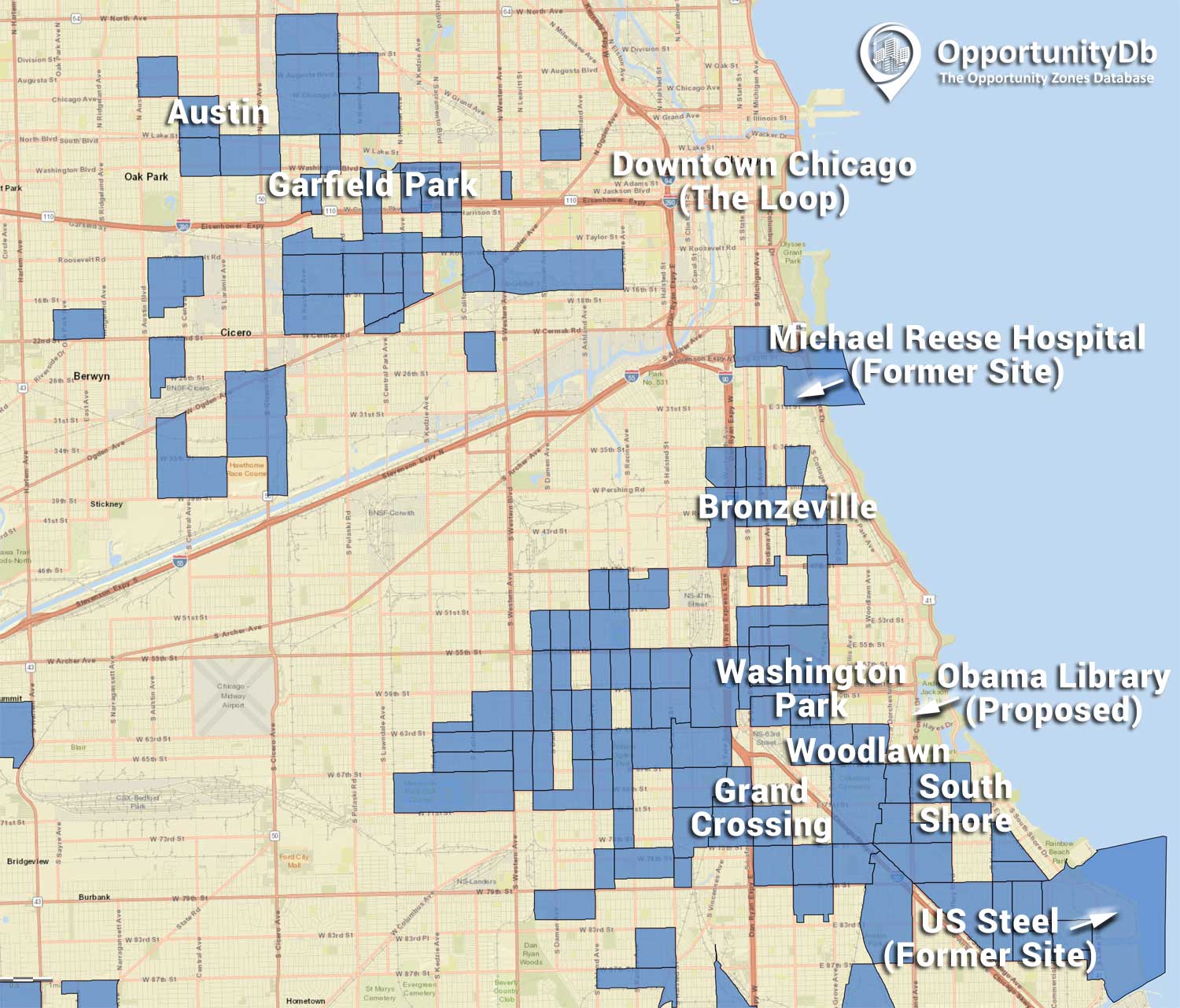

Map of Chicago

Below is a map of Chicago’s West and South Sides that highlights several of the sites discussed on this podcast episode. The blue shaded areas are opportunity zones.

Click the map to enlarge.

Featured on This Episode

- Lennox Jackson on LinkedIn

- Urban Equities

- Obama Presidential Library

- 2018 U.S. Farm Bill

- Illinois Hemp Growers Association

- Chicago Mayor-Elect Lori Lightfoot

- Alderman Patricia Dowell (3rd Ward)

- Michael Reese Hospital site

- Burnham Lakefront Project

- Lincoln Yards by Sterling Bay

- The 78 by Related Midwest

- Cornell Place in South Shore

Industry Spotlight: Urban Equities

Founded by Lennox Jackson in 1993, Urban Equities is a full-service real estate developer and advisory firm specializing in residential, retail, commercial, and mixed-use properties. Urban Equities provides development, program and project management, and construction services in Chicago.

Learn More About Urban Equities

- Visit UEquities.com

- Social Media: LinkedIn | Facebook

- Call Urban Equities: (773) 955-0812

- Call Lennox: (312) 619-7444

About the Opportunity Zones Podcast

Hosted by OpportunityDb.com founder Jimmy Atkinson, the Opportunity Zones Podcast features guest interviews from fund managers, advisors, policymakers, tax professionals, and other foremost experts in opportunity zones.

Show Transcript

Jimmy: What types of real estate assets are you looking to develop in the opportunities zones around Chicago?

Lennox: So the portfolio that we are working to, you know, get teeth around include a 15,112 square foot parcel in the Bronzeville community which is an historic community on Chicago South Side. And there we look forward to purchasing this particular property which has a commercial building on it. We’re gonna demolish it and we’re going to build a mixed-use market rate rental building, five stories with ground floor retail. And there we’re looking to deliver quality rental apartments. That particular project is also part of…well, is one of the projects in the portfolio. Another project includes acquisition and retrofitting a closed public school. This particular public school is located in the Washington Park community, again, just a little bit farther south of Bronzeville.

And Washington Park is one of the three communities that is as a geographic tie in to what will be the Obama Presidential Library and Presidential Center. And so we have put together a set of ideas around repurposing this particular school, which would include rooftop solar, converting about 30 to 40 formerly used classrooms to workforce rental housing. Another portion of the building would be used for training, workforce development and jobs training. And then another part of the building we want to align with a hydroponic indoor farming operation, which would include specialty herbs. And so we have identified a commercial farmer located in northern suburbs of Chicago that will relocate to this estimated 15,000 square feet portion of this school building. And they will then teach and train persons on how to develop and grow specialty herbs. So we’re talking about rosemary and other specialty herbs that will support a supply chain of restaurants in particular that are really becoming, you know, narrowly focused on the ingredients that they’re using in their meals. Because the customer, the consumer’s looking for something that’s unique as well.

So, and then finally, we are also at this particular location, this particular school, trying to integrate some activity around the hemp industry. For those who do not know, about four to five months, the U.S. government signed the U.S. farm bill, which legalized hemp as a commercial commodity in all 50 states. So what I’m proposing and what we’re planning around is not CBD oil, but instead we’re talking about converting hemp plants to commercial uses. A lot of folks have no idea that hemp material is being used in a variety of things, including clothing. And so we are really diving deeply into that, and we believe there’s an opportunity to build a rule to urban business model, whereby the farmers, some of the farmers throughout Illinois will have a place where their hemp material can come and be processed. And then again, this is all about job development and workforce development. And then those byproducts, those raw materials from the processing of the hemp would then be supplied downstream to manufacturers of various products. So that school is part of the portfolio.

And then we have another location in mind in the Grand Crossing community, which is just to the east of Washington Park. There we have another workforce development and housing campus. So we are partnering with a well-established, not-for-profit here in Chicago, that works in collaboration with the City Colleges of Chicago, as well as the Illinois Department of Corrections, with regard to workforce development and training. So they are specialized in creating a pipeline of workers to corporations and companies. And so one of the things that is being challenged, or represents a challenge, or barrier that we’re trying to identify solutions to overcome, is that in particular for those who are reentry individuals, oftentimes what prevents them from being successful upon their return home is housing. And so we are partnering with this particular not-for-profit to identify solutions around that. So in this particular location, there are three buildings adjacent to one another. One of the buildings is currently zoned residential. Our plan is to rehabilitate that building and to provide for workforce housing for those folks who will be trained and develop skills in these two adjoining buildings on the same property. So it’s what we call a workforce development and housing campus. So those are the three key targets for right now that represent our portfolio, but we’re gonna lead out or we’re gonna launch first with the project in Bronzeville.

Jimmy: Good. Yeah, that was the three projects. Just to recap is the 15,000 square feet in Bronzeville commercial building, mixed-use market rate. And then to the south of that, Washington Park is where you’re doing the school retrofitting and doing some…it’s gonna be indoor agriculture, some environmental controlled agriculture, it sounds like. Yeah, I was curious to know if you were doing any hemp or cannabis in there. So thanks for clarifying that you will be producing some hemp in there. That sounds interesting.

Lennox: Yeah, so just to clarify there, Jimmy, the hemp piece is we are looking to develop partnerships. We’ve already met with the Illinois Hemp Growers Association, believe it or not that organization exists now. And they’re the ones with the database and a network of the farmers who want to grow hemp. But what they’re challenged by is where does the hemp go once it’s grown. So the whole industry, I mean, this whole…well, not completely, but in large measure, the farmers are really trying to get some traction around this. And so next year, 2020 will probably be the first harvest of growth of any meaningful, scalable growth. And so what’s happening now is folks are trying to find a way to really drive the supply chain, and identify where the hemp material can go once it’s grown. And we’re looking to provide an answer or a set of solutions around that which we believe can result in a large number of jobs that are created in these communities, particularly in the Washington Park community.

Jimmy: And not just agriculture jobs, manufacturing jobs, manufacturing the raw materials, right?

Lennox: Manufacturing jobs.

Jimmy: Good. And then the third project was in Grand Crossing community, the workforce housing that you’re working with the Illinois Department of Corrections to I guess kind of a kind of almost like a halfway house for released.

Lennox: Yeah, so if you can visualize three buildings situated around one another, one is a residential building, the other is a garage for bay garage, and the other is a warehouse building of two floors. And so the residential building would be transitional housing. That is going to be fully maintained in a high quality way, that would allow for these residents to have a place to come, or these clients to have a place to come, not only for housing, but to be trained with some skills that will enable them to transition out of the housing at some defined period of time. So this is short-term transitional housing. I wouldn’t call it a halfway house per se, but I will call it dormitory living.

Jimmy: Gotcha. Thanks for the clarification. So those three projects sound great and should provide a big impact on the communities that you’re developing. What’s been the biggest challenge so far for you, Lennox, in the context of acquiring investment dollars? Or what do you anticipate will be your biggest challenge in luring investors to these projects?

Lennox: Well, the challenges are varied. I think I would start by saying that the investor community, and I do have…I’m in talks right now with two separate Opportunity Zone fund management organizations. But it has been a little bit of effort to get some attention, I think up to this point. And this is probably typical nationwide, folks have been gravitating to those markets that were already sort of moving along without any need for the Opportunity Zone fund program. And so I think that what has happened now is that those projects in those locations have become absorbed. And I think that investors now are slowly and gradually redirecting their attention to markets that are very specific to the legislation. And so we are very optimistic that we’re gonna get even more attention as we move ahead. Additionally, I think one of these challenges has been trying to make sure that the deal can pencil out. In other words, making sure that that return on investment is clearly demonstrated in the pro forma, and there is a clear understanding of how the investors are gonna be able to recapture their initial investment and make some money on top of that.

Another factor I think I’ve observed is that this has come very fast, meaning this legislation. I know it’s been, you know, came out end of December of last year, 2017, rather. But still, local governments are still trying to find their way in positioning themselves to be a good resource for not only the local developer firms like mine, but to the investors nationwide. So there are some cities that are farther along than Chicago. For example, like Baltimore, they have a web-based resource which is very well organized. And you can go as an investor, you can go there, and you can track down opportunities in opportunity zones, and the contact information is there as well. However, I think Chicago is about to pivot in this direction. As you may or may not know, Jimmy, we just elected a new mayor, Lori Lightfoot, who takes office later next month, several new aldermen, in some cities they refer to as city councilmen, have been elected. And so city government here is changing at the same time, I mean, at least city government leadership is changing at the same time as, you know, things really start to pick up steam around moving opportunities on projects for it.

So there’s a need for integration, there’s need for alignment, that I think will start to take place. I met yesterday at city hall with one of the local alderman Patricia Dowell, who’s alderman of third ward which includes Bronzeville. And she sees a great opportunity to attract the attention of the new mayor and to start to advance a set of ideas that can benefit the city overall. And then I would say lastly, one of the things that I’ve observed around this is that now real estate prices are starting to climb. So there are these unintentional consequences that are taking place at the same time, that all of these opportunity zone, you know, hoopla has been widely discussed around Chicago. And so now folks are becoming very aware that their property located in opportunity zones suddenly has little more value today than it did prior to the Opportunities Zone program. So what does that mean? Well, for in practical terms, for, you know, the deal maker like Urban Equities, now we’re gonna have to negotiate harder on acquisition prices. And so that’s one of those consequences that comes once something like this hits the street.

Jimmy: Right, yeah, that’s one of the risks of opportunities on investing is that the incentive could cause the market prices of opportunity zone real estate to go up. In fact, if they go up too much, it’ll start to negate the tax benefit. Right? So it’s a risk. So I want to talk to you a little bit more about real estate investing specifically in Chicago. I mean, typically, when one thinks of strong established markets in Chicago, they’re thinking of the Loop, or the North Side, some of the suburbs on the North Side. But there’s a lot of need for redevelopment, obviously, on the West Side, and in particular, on the South Side. In fact, that’s where all 133 of the city’s opportunity zones are located are exclusively on the West and South sides of Chicago. To you, which neighborhoods specifically have the greatest level of need?

Lennox: Well, the need is shared I would like to say probably equally between the West Side. And when I say West Side, I’m talking West Garfield Park and Austin. I grew up in the Austin community much of my childhood. But I would say the South Side has more vacant land. And then there are particular anchors, institutions I think that are on the South Side that would bode well for the South Side getting increased attention, I should say. With that, I would start with Bronzeville, and Bronzeville is a high place right now. And it’s good and bad. But the reason I suggest Bronzeville is in part because, again, those anchors. You’ve got McCormick Place which is located in Bronzeville, you’ve got the various hotels like the Marriott Marquis, McCormick Hyatt, the new Wintrust Arena which is DePaul University’s basketball arena, all within Bronzeville. You’ve got the major interstates, and you’ve got major transportation corridors, you’ve got access to Lake Michigan, you’ve got a large amount of vacant land. And you’ve got close travel proximity to downtown Chicago, whether you’re gonna get on the train or what we call the L or the bus here.

And then another reason I will say is that the Michael Reese Hospital site at 31st in Lake Michigan, 80 acres of vacant land except for one building which used to serve as one of the buildings of the Michael Reese Hospital site is slated for redevelopment. So that project, which is now referred to as the burn on Lake fund project is anticipated to be the next mega project. In case you are not aware, Jimmy, over the last week, the city council with the help of outgoing Mayor Rahm Emanuel, was successful, succeeded, I should say, in getting sign off by city council for two mega projects that are now gonna move out the gate, namely Lincoln yards by Sterling Bay up in Lincoln Park, and the 78 by Related Midwest which will become the 78th neighborhood in Chicago. Jointly, those two projects were approved for over $2.3 billion in public subsidy.

And so now these two locations are pretty much gonna satisfy the North Side and South Loop. So the only place to go next is south. And you’re gonna first hit Bronzeville. And so there’s a lot of opportunity in Bronzeville. And I think that the Michael Reese Hospital site will serve as a catalytic development under the administration of Lori Lightfoot. And I think that’s gonna be the next one to really drive widespread community and economic development change in that area of Bronzeville. And then coming from the south, you’ve got far south, meaning along around 100 South at the old US Steel site. That site is also in the opportunity zone. So I like to view that as the South bookend, if you view…we can consider the Michael Reese Hospital site is the North bookend, and the US Steel site as the South bookend. And so you got a huge bake and parcel out there that once developed will really start to serve as a major catalyst for development coming from the far south.

And then as you come from the far south, as you come farther north, going back towards Michael Reese, then you stop in South Shore, you stop in Woodlawn, where you have the new Obama Presidential Center, presumably that’s gonna get approved if this particular judge green lights it. But this is a long answer to your question. I think that Bronzeville, Washington Park, Woodlawn, which is already experiencing some very robust activity, and South Shore on the South Side. And then on the West Side, there’s a very strong need in the Austin community and West Garfield Park communities.

Jimmy: I don’t mind the long answer. Thank you for that. And for my listeners who are not familiar with the geography of Chicago, if you head over to the OpportunityDb website right now, you can find the show notes page for this episode, I’ll have a map of Chicago, and it’ll be labeled with some of the points that Lennox and I are discussing. So you can head over to opportunitydb.com/podcast to find that map of Chicago. But mostly we’re talking about the west and south sides of Chicago. They did drop Lincoln Park there for a minute. But that’s not opportunity zone eligible.

Lennox: No, right.

Jimmy: Do you know what percentage of people in these distress communities in Chicago own their own homes? And maybe you don’t have an exact answer but give me your thoughts on that.

Lennox: I don’t have an exact number, but nationwide black home ownership rate is less than 40%. With regard to the City of Chicago, last I remember you looking at less than 30%. And I’m being very specific, when I talk about the African American community. It is now trailing behind the Latino community in home ownership rates.

Jimmy: And those are predominantly the residents of these communities we’re talking about in Chicago are African American.

Lennox: Yes. And I should say also that one of the key influences of that, you know, ugly statistic, dates back to the predatory lending that took place that led to the bottoming out of the real estate mortgage market in 2007, 2008. Many of these communities, whether it’s Englewood, South, not as much as South Shore anymore, but Englewood, Woodlawn, Avalon Park, Grand Crossing, many of these communities are just now starting to see some signs of recovery, visible recovery from the predatory lending that took place in these communities.

Jimmy: Right. And I think that’s what we’re seeing all over the country. And that’s actually one of the impetus for the introduction of this legislation, that the economic recovery has been uneven. And that’s exactly one of the reasons why. So, you know, the hope is the promise of the legislation is that this tax policy will help rebuild some of these communities that have kind of gotten left behind from the recovery that has transpired since the market bottoming out in ’07 and ’08. Well, Lennox, we’re getting toward the end of our conversation today. But question I posed almost all my guests, I wanna pose to you now, what is your most memorable investment that you’ve made all time? Is there anything in particular that stands out for you?

Lennox: Oh, wow, that’s a tough one. I can answer it in the inverse. But I would say Cornell Place in South Shore, that was deconstruction and sell of 21 homes back in the, let’s see, that would have been around ’95, ’94 to ’96, 1994 to 1996. The reason that’s meaningful is because our firstborn, our son who is now 23, was born, that was in 1996. And we would…actually, my wife is a real estate broker. And we would actually bring him along as an infant to open up the sales model on weekends, including after church on Sundays. And we named the project after him, his name is Cornell. So we named it Cornell Place in South Shore. And so we actually bought a home in the development and he’s been raised here. He now lives in Los Angeles. And so if I flip that question around, in terms of my most painful project, it was in the Avalon Park community, some years ago in the early 2000s, when I developed another 24, 25 single-family homes. And before I really got real strong momentum, encountered some environmental problems.

And even though I had done through my due diligence process performed a phase one environmental report, I later learned that the Illinois EPA has this site on a different list. What does that mean? What did that mean? That meant that my budget just went completely south. And it meant that I started to lose hair then, because that turned out requiring me to enter that balance of the site into a site remediation program with the Illinois EPA, which caused me to have to remove underground storage tanks, and it required that I be baptized in this governmental process to clean up a community that quite frankly was left tainted by these businesses many, many years ago that vacated this community. And so I had no idea that I was gonna encounter any of this. And believe it or not, I had to vacate after I got it cleaned up and after I had no further remediation clearance letter from the Illinois EPA was issued, I actually abandon the balance of the project because it just broke me and it gave me a lot of lessons, a lot of lessons.

Jimmy: Yeah, that’s a tough one there. So you gave me one good one, Cornell, and one bad one, Avalon. But both very memorable investments for you.

Lennox: Yeah.

Jimmy: Well, Lennox. Thanks a lot for joining me today. Tell our listeners where they can go now to learn more about you and Urban Equities.

Lennox: Okay. Well, you can go to the website www.uequities.com. We’re also on LinkedIn. My personal information is on LinkedIn. I’m also personally on Facebook, and Urban Equities also has a Facebook page. And then our phone number office is 773-955-0812. And I wanna thank you again, Jimmy, for allowing me this opportunity to share with you.

Jimmy: Absolutely, Lennox, it was a pleasure. And for our listeners out there, I’ll have links to Urban Equities, and their Facebook page, and their LinkedIn page on the show notes for today’s episode. You can find those show notes at opportunitydb.com/podcast. Lennox, thanks again for joining me, this has been a pleasure. And I hope to see the fruits of your opportunity zone developments come to fruition soon.

Lennox: Thank you, Jimmy. I’ll keep you posted too by e-mail just let you know kind of how things are unfolding.

Jimmy: Okay. Please do. Thanks Lennox. Have a good one.

Lennox: All right. Have a good day.